The fact that Arizona residents typically pay less for photovoltaic (PV) rooftop panels than Wisconsinites is not particularly surprising. But sunshine hours alone do not explain the dynamics of the solar PV market, a recent study led by a University of Wisconsin–Madison researcher found.

Gregory Nemet, an associate professor at UW–Madison’s La Follette School of Public Affairs, and colleagues at other institutions identified the drivers of low-cost solar PV systems and the states in which they are most likely to occur. The team found that higher solar incentives, such as state subsidies, often lead eventually to the lowest-priced systems and spur further improvements in solar technology.

“What makes our approach unique is that we specifically compared characteristics of systems in the lowest 10 percent of the price distribution to the other 90 percent,” says Nemet. “We wanted to understand what it is about those low-priced systems that policy tools could help replicate elsewhere.”

For the study, the team evaluated more than 40,000 small-scale solar systems installed in the U.S. in 2013. Their cost varied widely, with the most expensive system costing five times more than the least expensive.

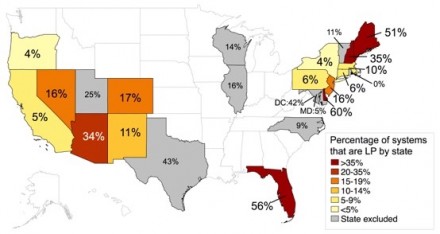

According to the analysis, low-cost systems were most frequently found in states with abundant solar resources, such as Arizona, Nevada, Colorado, New Mexico and Florida, but also in less sunny states, such as New Jersey, Connecticut, New Hampshire and Maine. While California had by far the largest number of solar PV installations, only 5% of them were low-priced.

Installation costs are influenced by several factors. The material, or hardware costs have seen a worldwide decline during the past decade, largely due to government subsidies in Germany and Japan that created a demand for cheap manufacturing companies in China.

The other part of the price tag is independent from the international market and consists of various “soft” costs, such as installation labor and the administrative costs associated with marketing, insurance, permitting, and financing.

These soft costs are influenced by state-specific solar subsidies and local, often utility-specific policies. The team’s earlier work had already shown that higher subsidies raise the average installation cost in the short term.

“This is not surprising,” Nemet says. “When people get free money, they are willing to pay a bit more because they don’t have to pay the full price. But because of learning-by-doing and economies of scale, subsidies lower average prices in the long term.”

By focusing on the lowest-priced ten percent of installations, the authors found that subsidies not only affect the average cost, but also broaden the price distribution by driving down its minimum.

Several mechanisms may explain this effect, the researchers noted. Higher incentives promote customer- versus third-party ownership and larger PV systems; and both factors were associated with a greater proportion of low-priced systems in the analysis.

Subsidies may also encourage new installation companies to enter the market, lowering prices through increased competition. In the long run, however, higher subsidies tend to produce a market with a small number of large installation companies. By gaining more experience, these companies can optimize the installation workflow in their service area, resulting in reduced consumer costs.

When larger companies compete with each other, new cost-cutting measures may also be developed, such as working with the local utility to speed up the permitting process. The authors suggested that this might explain price variation in large solar markets with identical state subsidies, such as California.

Nemet offers this take-home message to policy makers: “Our analysis suggests that we’re on the right track. To me, the biggest reason for solar subsidies is the price reduction that comes with gaining more installation experience. Our data show that this is pretty effective. In addition, we’re also seeing that these policies stimulate the industry to experiment with new approaches for reducing soft costs, which can then become models for other places.”